Here are some tips for a flood protection system and minimizing damage in flood zone X regions: While flood zone X doesn't tend to pose a huge risk, you should still be prepared in case a flood occurs.

Typical flood insurance cost how to#

How To Minimize Damage in Flood Zone X Regions

Typical flood insurance cost free#

FEMA has a free online tool to find a participating NFIP flood insurance provider near you.

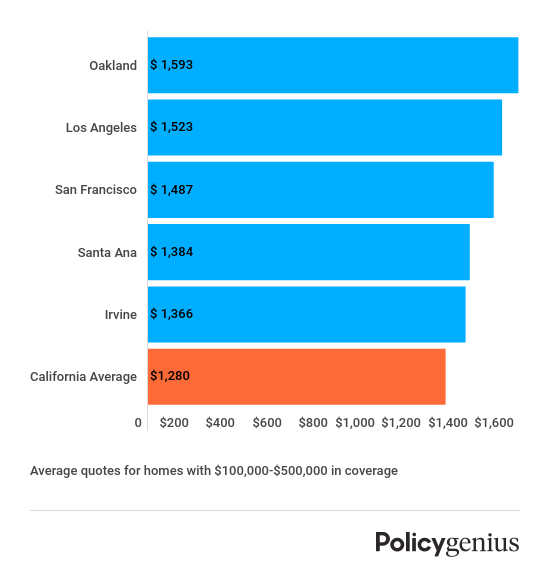

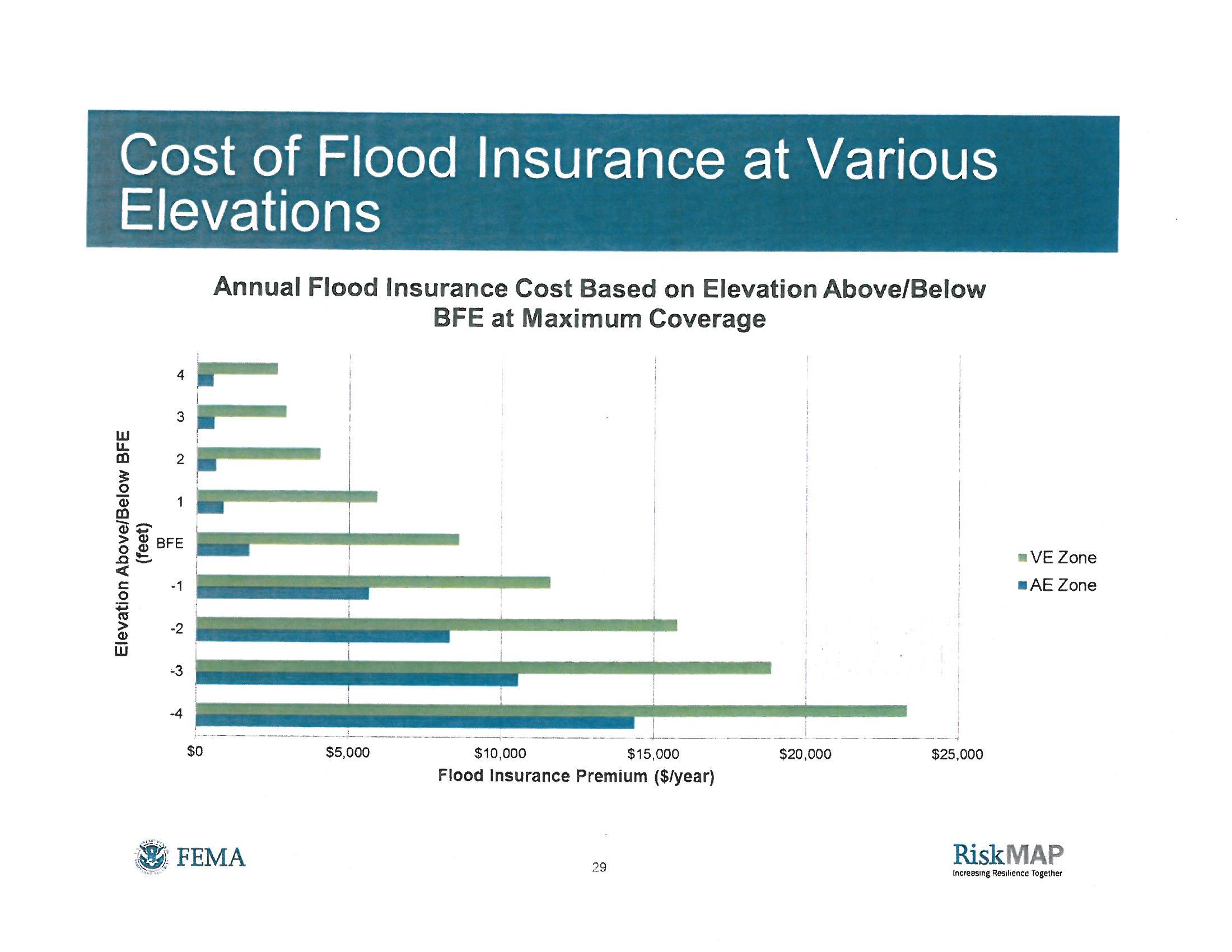

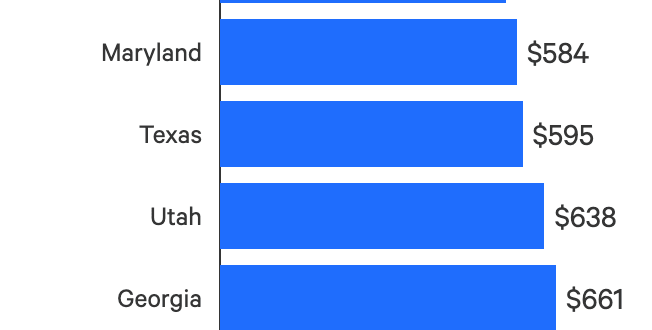

We also include rates for zone A to show how the rates in a high-risk flood zone can be considerably higher than a low- to moderate-risk zone like zone X. Here is a breakdown of states with the highest average cost for zone X. * Based on average premiums for policies for both dwelling and contents coverage You will need to purchase separate coverage.īelow is a map showing how average premiums for zone X can vary considerably depending on your state.* Keep in mind that standard homeowners insurance does not cover floods.

The average cost of flood insurance will vary by state, with average annual premiums ranging from $480 to $792. On average, homeowners in zone X pay $768 per year for an NFIP flood policy. How Much Does Flood Insurance Cost in Zone X? Unshaded areas have less than a 0.2% annual chance of flooding. On the other hand, if zone X is not shaded on a flood map, then it is an area with a minimal flood hazard risk. The annual probability of flooding in this zone is between 0.2% and 1%. If zone X is shaded on a flood map, it indicates an area with a moderate risk of flooding. When looking at a flood map, you may notice that some areas designated as zone X are shaded or unshaded. Properties located in flood zone X may not be required to carry flood insurance by mortgage lenders, although it may still be recommended. These designated areas have a 1% or less chance of experiencing a flood in a given year. Flood zone X is an area with a moderate or low risk of flooding based on the flood insurance rate map (FIRM) created by the Federal Emergency Management Agency (FEMA).

0 kommentar(er)

0 kommentar(er)